My Very First and Exciting Experience in GNAM Stock Trading Game

- Gao Xiaotian - IMBA Class of 2022

- 2021-02-22

I am Gao Xiaotian(Toby), Currently a first year IMBA student from Class of 2022 at Renmin Business School. I have the engineering background and once worked as PMO in a leading enterprise of display products. I’m good at data analyzing and industry researching.

I am Gao Xiaotian(Toby), Currently a first year IMBA student from Class of 2022 at Renmin Business School. I have the engineering background and once worked as PMO in a leading enterprise of display products. I’m good at data analyzing and industry researching.

At the end of the first semester in 2021, I came across the global Stocking Trading Game (STG) held by Yale SOM. This game involved more than 12 GNAM schools all over the world. To apply what I have learnt from the textbooks and in the class, I participated in the game and competed with more than 500 traders in the first round and reached the final round together with another 12 Renmin students, with 81 competitors in total for the final round. Fortunately, on behalf of RMBS, I won the third place.

There was first the practice round held in late January 2021 and we noticed that the transaction speed was faster than we can react to make trades. Players should focus on four virtual stocks: green, orange, red and blue company. The trading information will be displayed on the public board, and you can trade your stocks by placing orders. Sometimes you may fall behind others just the moment you see an appropriate price to trade. So, the smooth functioning of the internet and how quick you can make decisions are very important in the game.

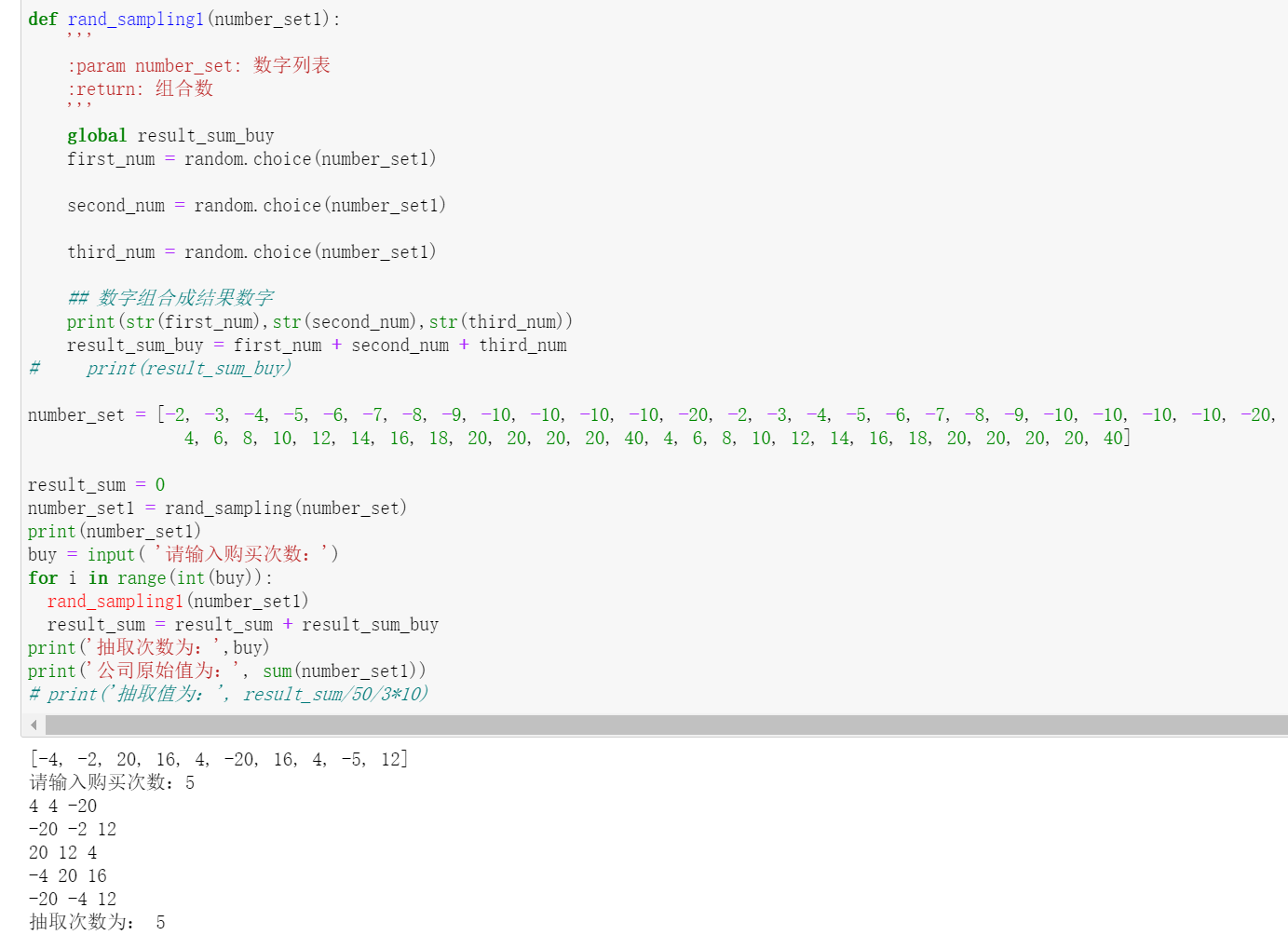

I didn’t even beat the market in the practice game. I reflected upon the trading performance and realized that the most important thing I have missed is the EPS changing of stocks in the course of the game. In my opinion, the EPS is the only variable thing in this game, because the original value will not change, the final value can only be determined by the EPS change. Another import thing is the private information which can be bought by virtual cash. From the private information, players can guess the original value of each company. To test my thought, I wrote a small program to stimulate the game system.

With the help of the small program I developed, I was able to identify 70-80% of the company’s original value with rest left to guess. That’s also the funny part of this game. Through this way, you can get the original value of all the companies by combining all the possible combinations. After guessing the original value, you can make the short-term arbitrage trades. If you find out a company with the market value deviating from the original value, you can also trade ahead for long term. The last but not least is focusing on the EPS change which is very important in both long term and short term as it affects both market behaviors and original value.

In the final round on 17 February, I made good use of the experience I obtained from previous rounds and I’m so happy that I have won the third place in the game. Moreover, I would like to share what I have learnt and gained from this STG experience: to sum up, this stock game reflects the real market to some extent. Firstly, in the real word, you only have limited information about the company and don’t know the real value. Secondly, you may have arbitrage chances only if you could follow the pace of the market. Thirdly, you should have the ability to get to the point quickly when you are faced with a flood of information because time waits for no one. By the way, you should also have a good internet connection to act in accordance with the change of market.

All in all, thanks Renmin Business School and Yale School of Management to provide us this good opportunity to experience and understand the real stock market and beyond. I really have had a good time!